Delinquency

Delinquency Call Line

Unable to determine cause of delinquency?

Call 916-210-6607 to speak with Registry staff during business hours (Monday – Friday, 8 am to 4 pm PT), or leave a voicemail.

Webinars

Delinquency Webinars

The Attorney General's Office hosted, and has made available, a webinar providing step by step instructions for remedying a delinquent status. The webinar also includes the filing requirements, details about Form RRF-1, and how to check an organization's status using the Registry Search Tool.

When a charitable organization fails to submit complete filings for each fiscal year, its status on the Attorney General's Registry of Charities and Fundraisers will be listed as Delinquent. If the delinquency is not remedied, the Registry status will be further changed to Suspended, and/or Revoked. A charitable organization that is not in good standing with the Registry of Charities and Fundraisers because of delinquency, suspension, or revocation may not operate or solicit donations in California. (Cal. Code Regs., tit. 11, § 312.) If your charitable organization received a delinquency letter it is because it has not filed one or more of the required annual reports with the Registry. The Registry's Delinquency Program provides guidance to assist delinquent charities and trustees.

Updated Annual Registration Renewal Webinar- Paper Submissions

- Form RRF-1 along with either

- Copy of IRS Form 990, 990-EZ, or 990-PF as filed with the IRS except:

- Schedule B is not requested or required by the Registry.

- Please exclude all pages of Schedule B from your IRS Form 990, Form 990-EZ or Form 990-PF filing with the Registry, including the first page.

- Please do not submit redacted, blank or Public View versions of Schedule B – exclude all pages entirely from your filing with the Registry.

- The Registry does not require a copy of IRS form 990-N.

- Schedule B is not requested or required by the Registry.

- If your organization is not required to file and does not file IRS Form 990 or 990-EZ because it does not meet the revenue requirements, your organization must submit Form CT-TR-1 with the Registry.

- Registrants who file IRS Form 990, Form 990-EZ or Form 990-PF with the IRS must also file the same with the Registry as part of their annual filing regardless of revenue or any other factor. Form CT-TR-1 is not required from these registrants.

- Copy of IRS Form 990, 990-EZ, or 990-PF as filed with the IRS except:

- Renewal fees as specified on Form RRF-1.

Other forms not specifically requested (e.g. IRS Form 8879, FTB Form 199) are not required by this office.

Required annual filings and registration fees are due 4 months and 15 days after the charitable organization's fiscal year ends unless the IRS has granted an extension. Registrants granted an extension of time from the IRS should not file with the Registry before filing with the IRS. After filing with the IRS, registrants must file a complete package with the Registry that includes the forms, fees and other documentation listed above in the Required Annual Filings section.

IRS Form 990(-EZ/-PF) filers: Schedule B is not requested or required by the Registry. Please exclude all pages of Schedule B from your filing that you submit to the Registry, including the first page. Please do not submit redacted, blank or Public View versions of Schedule B – exclude all pages entirely from your filing with the Registry.

For your annual filing due date, click on your fiscal year ending date:

Your due date is June 15, or December 15 with IRS extension

Your due date is July 15, or January 15 with IRS extension

Your due date is August 15, or February 15 with IRS extension

Your due date is September 15, or March 15 with IRS extension

Your due date is October 15, or April 15 with IRS extension

Your due date is November 15, or May 15 with IRS extension

Your due date is December 15, or June 15 with IRS extension

Your due date is January 15, or July 15 with IRS extension

Your due date is February 15, or August 15 with IRS extension

Your due date is March 15, or September 15 with IRS extension

Your due date is April 15, or October 15 with IRS extension

Your due date is May 15, or November 15 with IRS extension

-

Form RRF-1 & Instructions, pdf

Annual Registration Renewal Fee Report

Form RRF-1 must be filed annually along with either IRS Form 990, 990-EZ or 990-PF within 4 months and 15 days after the end of an organization's accounting period. IRS extensions are honored by the Registry – please file with the IRS first. Registrants who are not required to file and do not file IRS Form 990 or 990-EZ because they do not meet the revenue requirements must file Form CT-TR-1 annually along with Form RRF-1.

-

Form CT-TR-1 & Instructions, pdf

Annual Treasurer's Report

Registrants who are not required to file and do not file IRS Form 990 or 990-EZ because they do not meet the revenue requirements must file Form CT-TR-1 annually along with Form RRF-1. Registrants who file IRS Form 990, 990-EZ or 990-PF do not need to file Form CT-TR-1.

-

Annual Financial Solicitation Report

For use by a charity that solicits for charitable purposes, (1) collects more than 50% of its annual income and more than $1 million in charitable contributions from donors in California during the previous calendar year, and (2) spent more than 25% of its annual income on non-program activities as defined in Business and Professions Code section 17510.9.

- Online Renewal Checklist, pdf

Checklist includes guidance and instructions for using the Online Renewal System.

- IRS Form 990 Series and Instructions

- Note: Schedule B is not requested or required by the Registry. Please exclude all pages of Schedule B from your IRS Form 990(-EZ/-PF) filing that you submit to the Registry, including the first page. Please do not submit redacted, blank or Public View versions of Schedule B – exclude all pages entirely from your filing with the Registry.

- The Registry's Guide for Charities Page

- Nonprofit Transactions Requiring Notice or Attorney General Approval

- Audit Requirements under the Nonprofit Integrity Act

- Executive Compensation under the Nonprofit Integrity Act

- California Law On Charitable Solicitations - Business and Professions Code Sections 17510 - 17510.95

- California Regulations on the Supervision of Trustees and Fundraisers for Charitable Purposes (Cal. Code Regs., tit. 11, § 300 et seq.)

A charitable organization that has failed to file one or more of the required annual reports with the Attorney General's Registry of Charities and Fundraisers (Registry) may be sent a delinquency notice. Unless specifically exempt from registration and reporting under the Supervision of Trustees and Fundraisers for Charitable Purposes Act (Government Code sections 12580-12599.10), all charitable nonprofit corporations, unincorporated associations, trustees, and other legal entities holding assets for charitable purposes must register and file annual reports with the Registry. Any charitable organization established outside of California, but is doing business or holding property in California for charitable purposes must also register with the Registry.

To renew registration, charitable organizations and charitable trusts must file the Registration Renewal Fee Report (Form RRF-1) annually with the Registry. Along with Form RRF-1, a copy of the IRS Form 990, 990-PF, or 990-EZ with all applicable public schedules filed with the Internal Revenue Service, or if the organization’s revenue for the fiscal year was under $50,000, the Annual Treasurer’s Report (Form CT-TR-1), must also be filed with the Registry.

A charitable organization that is not in good standing because it is delinquent may not operate or solicit donations in California. This includes not being able to be listed in solicitations or receive donations through charitable fundraising platforms. If the delinquency is not fixed, the organization’s status will be further changed to Suspended, and/or Revoked and may result in penalties. The Franchise Tax Board will also be notified about the delinquent status and the organization may lose its tax exemption.

Charitable organizations operating in California are required by law to renew registration each year and file a report regarding their activities of the prior year. An organization should not assume that it is current with its registration because it did not receive a delinquency notice. The organization’s public file, including its registration status, is available online. An organization should regularly check its registry status using the Registry Search Tool.

The Attorney General is charged with the general supervision of all organizations and individuals who obtain, hold or control charitable assets. The Attorney General has the primary responsibility for supervising charitable trusts in California, for ensuring compliance with trusts and articles of incorporation, and for protecting assets held by charitable trusts and public benefit corporations. (Gov. Code, § 12598, subd. (a).) The Registry of Charities and Fundraisers assists the Attorney General by administering the statutory registration and reporting program for all organizations and individuals that control and/or solicit charitable funds or assets in California.

The State Charity Registration Number is assigned to an organization by the Registry of Charities and Fundraisers at the time of initial registration. If the organization has received a letter from the Registry, the Registration Number is located at the top of the letter. The Registration Number is different from the corporate or organization number (entity id) and the Federal Employer Identification Number (FEIN). The corporate or organization number is issued by either the CA Secretary of State (SOS) or CA Franchise Tax Board (FTB) and the FEIN is issued by the Internal Revenue Service (IRS).

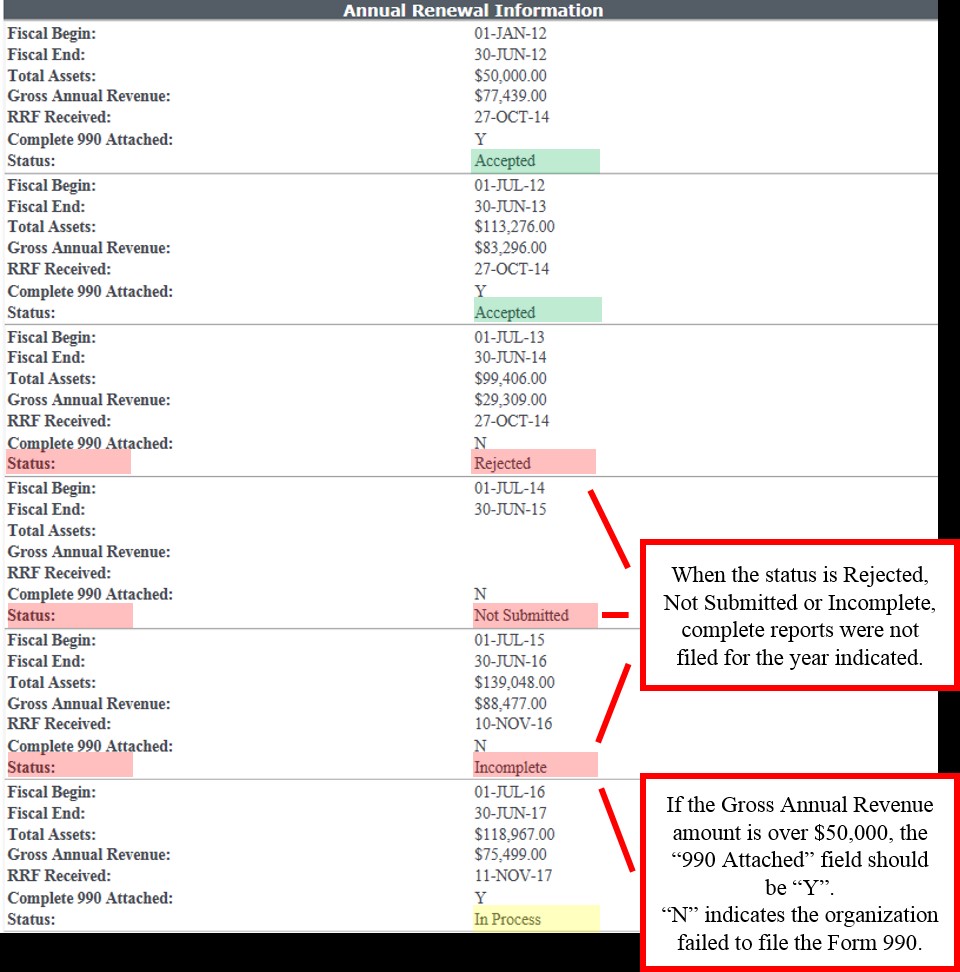

Use the Registry Search Tool to view the reports that are on file with the Registry of Charities and Fundraisers. If the organization has received a letter from the Registry, the State Charity Registration Number is located at the top of the letter, and that number can be used to search for charity's records. The reports that are on file with the Registry will appear under the heading Annual Renewal Information.

The organization is required to file complete reports every year with the applicable renewal fee. If the Status is Rejected, Not Submitted, or Incomplete, complete reports were not filed for the year indicated. If the Status is Incomplete and the Complete 990 Attached field is N, it indicates that the IRS Form 990 has not been filed with the Registry for that year and is considered incomplete if the revenue amount for the fiscal year is over the IRS threshold for filing a return.

A screenshot of the Registry Search Tool details page is shown below for reference.

The Registry of Charities and Fundraisers is a separate agency from the IRS. Filing any version of IRS Form 990 with the Internal Revenue Service does not mean that filing requirements are met with our office. We require a copy of the IRS Form 990, 990-EZ or 990-PF as filed with the IRS except that Schedule B is not required. Please exclude Schedule B from your filing with the Registry. See California Code of Regulations, Title 11, section 301.

California Code of Regulations, Title 11, section 301 requires the filing of the IRS Form 990, 990-PF, or 990-EZ with the Attorney General's Registry of Charities and Fundraisers as part of the charitable organization's registration and reporting requirement with the Registry. Third-party websites that scan informational returns (IRS Form 990) filed directly with the IRS do not fulfill the charity's independent obligation to file directly with the Registry. Registry staff from the Delinquency Program cannot utilize filings from a third-party online source to fulfill the organization's independent filing requirements.

An annual audit is required for organizations that report $2 million or more in total revenue. For more information pertaining to the annual audit, please review Audit Requirements under the Nonprofit Integrity Act and our Frequently Asked Questions regarding the Nonprofit Integrity Act of 2004.

When an organization repeatedly fails to comply with the registration renewal requirements, a Notice of Intent to Suspend or Revoke Registration (ITS) is issued and late fees are assessed. The late fees cannot be waived and are calculated at $25 per month or partial month starting the 31st day after the 1st Delinquency letter was mailed. An organization must satisfy all the requirements of the ITS to stop the late fees from accruing.

*NOTE: Use of charitable assets is restricted to charitable purposes. Charitable assets cannot be used to pay Late Fees. Using charitable assets to pay penalties generally constitutes a waste of charitable assets and damage to the charity. A director that has committed a breach of fiduciary duty or breach of trust by allowing avoidable penalties to be assessed may be held liable for any damages to the charity. See, for example, Business and Professions Code, § 17510.8; Corporations Code, §§ 5210, 5231, 5239.

The documents filed with the Registry that are public filings include IRS Forms 990(-PF/-EZ), initial registration forms, founding documents (e.g., articles of incorporation), financial audits, and the annual registration renewal Forms RRF-1 and CT-TR-1. The Registry does not retain or does not make available for public viewing certain records and information submitted with filings that should remain confidential or are not required or requested. For example, Schedule B is not required by the Registry. Please exclude Schedule B from your IRS Form 990, Form 990-PF or Form 990-EZ filing with the Registry.

If you are filing documents that you believe should be maintained as confidential, please separate the pages that contain confidential information and add a cover sheet indicating that they should be maintained confidential.

The Registry Search Tool allows a charity's public filings to be viewed and downloaded directly from the Registry database.

Contact your organization's tax preparer and/or attorney. Tax and legal professionals will often retain copies of prior filings and/or historical documents prepared on behalf of an organization. You can request a complete IRS Form 990 directly from the IRS with IRS Form 4506.

If an organization filed Form 990-N and cannot locate their accounting records or banking documents, they may need to request past statements from the bank(s). If the banking records are not available for the requested years, ask the bank to provide a statement on their letterhead indicating why the records are not available. The organization will also need to write a letter (on the organization's letterhead) explaining in detail why they could not locate their accounting records for the fiscal year in question. Both letters need to be submitted to the Registry for further review.

The registration and reporting requirements are not limited to entities that are tax exempt under section 501(c)(3) of the Internal Revenue Code. The Supervision of Trustees and Fundraisers for Charitable Purposes Act (Government Code section 12580 et seq.) requires registration and annual reporting by all charitable nonprofit corporations, unincorporated associations, trustees, and other legal entities holding assets for charitable purposes.

With very limited exception, the Supervision of Trustees and Fundraisers for Charitable Purposes Act applies to any person/entity holding money or property for charitable purposes, including entities that are tax exempt under other subsections of section 501(c), entities that are not tax exempt, for-profit entities that hold assets for charitable purposes, and organizations established outside of California that are doing business or holding property for charitable purposes in California.

Regardless of an organization's exempt status, all charities are required to file Form RRF-1 every year until they are dissolved or withdrawn.

Please contact the IRS and/or the Franchise Tax Board, if applicable, for instructions on how to reinstate and/or revive your tax exempt status. The IRS and Franchise Tax Board are separate entities from the Registry of Charities and Fundraisers.

Regardless of an organization's activity level, all organizations are required to file Form RRF-1 every year. If the organization has been dormant and has not received charitable contributions of any kind during a specific year, that information should be reported on Form RRF-1 by indicating zero ($0) revenue for that year. Organizations must still provide the value of the total assets for each fiscal year.

If your organization no longer intends to operate, you may wish to withdraw or dissolve the organization. Please visit our Dissolution webpage for additional information.

Please visit our Dissolution webpage for additional information. An organization cannot dissolve until it has resolved all issues that lead to delinquency.

Please use our Contact the Delinquency Program form and include your name, the organization's name, State Charity Registration Number and/or FEIN, contact phone number, and questions/reasons for contacting us.

Documents and payments should be mailed together in one envelope. If the organization received a letter from the Registry, include a copy with your documents. Please write your State Charity Registration Number on any payments to prevent delays in processing.

Registry of Charities and Fundraisers Mailing Address:

Regular or Registered Mail:

Registry of Charities and Fundraisers

PO Box 903447

Sacramento CA 94203-4470

or

Overnight Mail:

Registry of Charities and Fundraisers

1300 I Street

Sacramento CA 95814

The Registry of Charities and Fundraisers will revoke the registration of an organization if it continually fails to respond to Registry's delinquency and suspension notices. If an organization's registration has been revoked, conditional reinstatement is possible, but it must be reviewed and approved by the Registrar of the Registry of Charities and Fundraisers.

An organization that has had its registration revoked may file a petition to have it reinstated pursuant to California Code of Regulations, title 11, section 346.

A petition for reinstatement will not be reviewed until all of the following are submitted:

- All deficient filings and renewal fees,

- Proof of compliance with the requirements/good standing with the IRS, California Franchise Tax Board and California Secretary of State,

- An explanation of why the organization failed to comply with the registration and reporting requirements and failed to respond to notices from the Registry of Charities and Fundraisers, and

- An explanation that will provide sufficient assurance to the Registrar of the Registry of Charities and Fundraisers that the violations will not recur in the future if the petition for reinstatement is granted.